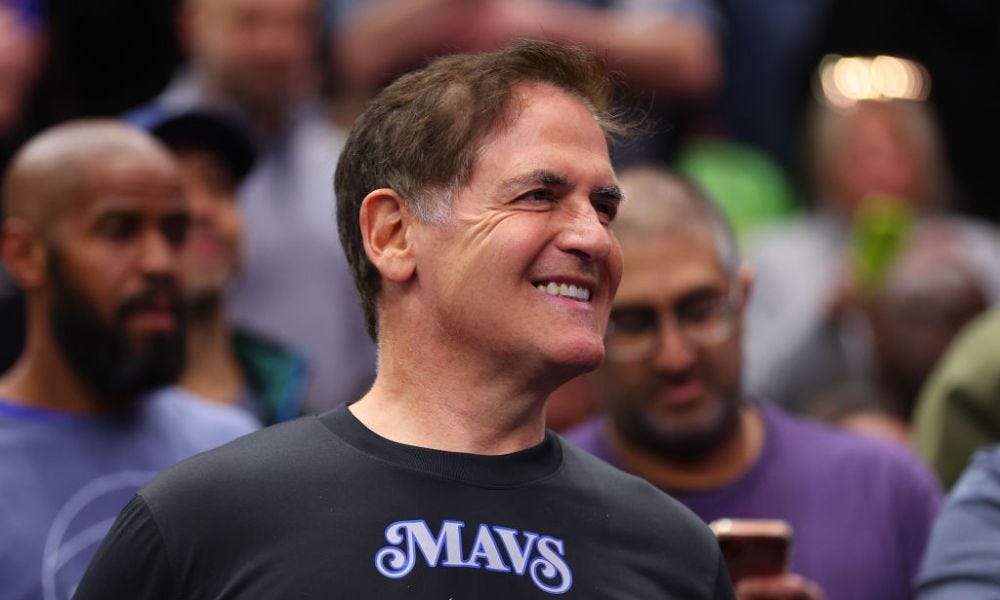

Mark Cuban’s Minority Stakes Play: Why the $750M Harbinger Fund Signals a New Era of Sports Ownership

Cuban joins forces with Williams and Cannon to back media-savvy franchises—shaping how capital, culture, and control converge in pro sports.

It’s easy to forget that when Mark Cuban bought the Dallas Mavericks in 2000 for $285 million, people laughed at the price tag. Today, that same franchise is worth over $3.5 billion, and Cuban’s stepping back from majority ownership just as sports investing reaches a whole new level of sophistication.

Now, he's taking on a very different role. As general partner in a new $750 million private equity fund called Harbinger Sports Partners, Cuban is placing a bet not on control, but on access. The fund plans to acquire minority stakes, up to 5%, in NBA, NFL, and MLB teams, with deal sizes ranging between $50 million and $150 million. In total, the goal is to build a portfolio of 15 franchises and exit via secondary offerings within a decade.

It’s a calculated pivot, and a signal to the wider business world: sports ownership is no longer just a billionaire’s playground, it’s becoming a well-oiled, media-leveraged, institutional-grade asset class.

Cuban’s new partners in the venture are no small names either. Rashaun Williams, who holds a minority stake in the Atlanta Falcons, brings serious credibility as a cultural investor and former tech banker. Steve Cannon, the former CEO of AMB Sports & Entertainment, ran the Falcons and Atlanta United and oversaw the development of Mercedes-Benz Stadium, one of the most tech-forward venues in the world. Together, they form a rare blend: cultural awareness, financial rigour, and operational know-how.

But this fund isn’t just about portfolio building, it’s about redefining what ownership means.

For decades, owning a sports team meant gate receipts, concessions, TV rights, and selling jerseys. That was sports 1.0. Harbinger is playing in the 2.0 arena, where a team is no longer just a team, but a media company with a global audience, a brand with licensing power, a content engine, and an IP goldmine. Williams has openly said they’re looking for franchises that embrace this shift: those who know they’re selling more than just sport, they’re selling culture, community, and content.

This is where Cuban’s involvement gets particularly interesting. During his time with the Mavericks, he was often ahead of the curve, embracing digital, transforming the fan experience, and challenging league norms. Now, instead of running a single franchise, he’ll help shape the future of 15 of them, from the boardroom outwards.

Follow me for more sports and life updates: Instagram

What makes Harbinger stand out in a market that already includes major players like Arctos, Dyal HomeCourt, and RedBird Capital is its focus on minority, non-controlling stakes. That strategy is key. It allows the fund to move faster, get into deals others can’t touch, and support ownership groups without threatening power structures. In a climate where valuations are ballooning and controlling stakes are scarce, minority investments offer a way in, without the politics.

And thanks to recent league rule changes, it’s suddenly viable. The NFL now allows private equity to hold non-controlling stakes in up to six teams. The NBA allows 20% across five clubs. MLB has lifted its limits entirely. Institutional money is no longer a threat, it’s a solution to succession planning, liquidity issues, and capex for stadium builds or media tech.

This doesn’t mean the play is without risk. Minority stakes don’t guarantee influence. There’s limited ability to shape strategy. Exit paths, usually via secondaries, depend on continued growth in valuations. And in an era where media rights might plateau and global expansion gets harder, long-term appreciation isn’t a given.

But Harbinger isn’t just offering money. The pitch is value beyond capital, with support for media monetisation, operational upgrades, brand building, and even talent partnerships. Think of it as strategic venture capital for sports teams, except instead of funding startups, they’re backing legacy institutions that want to act like startups.

That cultural alignment matters. Teams aren’t just performance engines anymore. They’re brands with style collabs, digital content studios, social audiences in the millions, and athlete-investors who shape their image. A fund that understands that, one that isn’t just chasing EBITDA but understands the value of having the right rapper courtside, the right partnership with Netflix, the right creative director on the stadium revamp, has an edge.

Cuban’s move also mirrors a broader trend: the rise of the minority stake mogul. Celebrities, athletes, and financiers alike are opting into sports ownership not as vanity investments but as strategic brand extensions. From LeBron and FSG to Jay-Z and Roc Nation’s NFL ties, the game isn’t about running the club anymore, it’s about owning a seat at the table where decisions around culture, content, and capital converge.

In this context, Harbinger isn’t just another fund. It’s a proof of concept for a new type of investor. One that doesn’t need to run the team to shape its trajectory. One that can plug in, create value, and scale the playbook across a portfolio of franchises.

Thanks for reading, David Skilling.

Follow me on LinkedIn | X | Instagram

If you hit the like button, you’ll be doing me a huge favour, and if your business needs sports writing, wants to discuss advertising, or you have PR stories to pitch, feel free to get in contact.

If you know someone who will enjoy this article, please share it with them.